Entrust your Swiss tax declaration to the professionals

At the 2017 EXPERTSuisse conference, our company was recognized as a Best Practice Case for its pioneering approach. Leveraging our innovative structure, the abrechnungen.ch team has completed more than 5,000 tax returns at attractive terms.

Why choose abrechnungen.ch for tax services?

- We speak (Swiss-)German, English, Russian and Ukrainian

- We work with all German-speaking cantons

- We resolve complex tax issues quickly and effectively

- We support you throughout the entire tax filing process

- We offer transparent rates and fixed-price services

- We provide discounts for returning clients and referrals

Listen to the «Deep Dive» podcast about abrechnungen.ch tax services (9:17)

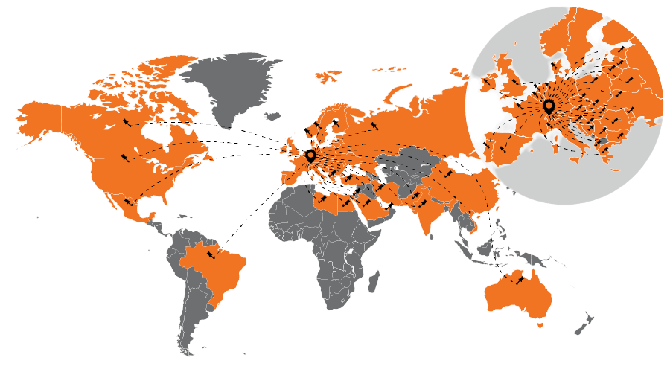

Geography of our clients

Expats from around the world trust us to prepare their Swiss tax returns

Tax return preparation pricing

The complexity of preparing a tax declaration in Switzerland depends on many factors such as canton, marital status, income, assets, and more. To offer you a relevant fixed price, please send us a free inquiry with some basic information.

Below, you can find examples of typical tax cases and the pricing for preparing Swiss tax returns.

Our specialists also provide advice on various topics related to individual tax, tax location comparisons, and pension contributions. The hourly rate for such consultations is CHF 130. To request a consultation, describe your tax situation and our advisor will contact you to clarify the details.

Examples of tax return prices

All prices excl. Swiss VAT

Our 30-page free tax book for download.

Many practical examples and hints for your private Swiss tax declaration.

Download Tax Book

Undeclared cryptocurrencies?

From 2026 onwards, expect increased scrutiny from the tax authorities.

Read more

Tax return inquiry

Please fill out this form so we can assess your tax situation and provide a quote for preparing your tax return. Once you submit your request, one of our specialists will contact you within 48 hours. Please note that we can only give advice after you have received our pricing offer (no direct tax consulting by phone).

Feedbacks

«abrechnungen.ch offers a really good price-value ratio for me and my clients.»

Dr. iur. Peter Schmid

Attorney-at-law

SGA Swiss AG, Bäch

Tax consulting services

- Examination of the final tax assessment

- Simulation of tax burden based on various cantons (tax residency)

- Examination of “marriage penalty» in case of planned marriage

- Consultations regarding pension funds

- Tax representation upon relocation abroad (for expatriates)

- Tax optimization

FAQ

Yes, we actually offer a fixed price for tax declarations. Due to years of experience, and after careful study of the documents received, we can normally estimate the required time for filing your tax return properly, and can therefore make you a fair fixed-price proposal.

You receive transparency, security and a high-quality service from us.

The prices listed above are examples that show what the filing of a tax return by us can cost, depending on income, assets and family circumstances.

The actual costs depend on your specific situation. The actual costs can be found in our proposal.

We specialize in all foreigners living in Switzerland. Most of our clients have residence permit B (so, they are taxed at source/pay the withholding tax).

But of course, we also gladly support all other taxpayers, who seek assistance in preparing their tax return.

Yes, you are right to choose our company. We can gladly carry out necessary clarifications for you. However, we would like to point out that this clarification is for a fee, and that unfortunately, we cannot do it as a complimentary service.

Just fill out the short form above, and leave us a comment or your question. One of our specialists will contact you as soon as possible.

Unfortunately, the receipt of documents in physical form is not possible. We rely on a completely digitalized concept. That is one of the reasons that we can offer you a quality service at an attractive hourly rate of CHF 130.

Our concept does not provide for personal meetings. From our experience, they are not necessary. This is primarily for the reason that we want to offer you a quality service at an attractive hourly rate.

In the case of complicated tax situations, which require support and advice, a personal meeting in Zurich can be arranged. However, this not a part of the fixed-price proposal and it will be charged separately for the effective time spent, at the hourly rate of CHF 250 excl. Swiss VAT.

Tax returns are processed upon receipt of the order. The average processing time is 5 – 15 days (depending on season).

In urgent cases, we can complete your tax return more quickly for a slightly higher fee—please let us know if it’s very urgent. We’ve even managed to complete tax returns on the same day. Our Google reviews highlight our exceptionally short processing times compared to other providers.

No problem. We will be able to meet your desired deadline. In case we are unable to meet it, we will request an extension on your behalf. This will have no negative consequences for you.

Yes, if your declaration was prepared by our company last year, you will receive a 20% discount when returning to us for this service.

Yes, our tax team provides this service, which includes reviewing and verifying the final tax assessment, along with recommendations for optimal communication with the tax office. If necessary, we can also draft a letter on your behalf.

Yes, this is possible, but it is not recommended. The price for such a service remains standard because we will still need to verify the sections you completed, which may take as much time as starting from scratch.