Any investor is by definition anxious about the possibility of losing the investment. This anxiety is actually not unjustified towards start-ups or unsecured loans. It can be however reduced through a foresighted planning. The main point here is not to pull the wool over the investor’s eyes, but to deploy efficient strategies to minimize the risk.

The concept of risk management often carries negative connotations, as it aims to calculate the probability of large losses or threatening events for a company, so that appropriate counter measures can be taken. At the first glance, this appears not especially productive.

With this in mind, scenario analyses are often used in financial planning. They show (or rather must show) an investor that there will be enough means for the company to survive even in the worst case. These scenarios also help the entrepreneur to take counter measures early on and to understand the sensitivity of certain influence factors by a realistic forecast. In most of our business plans, we deploy such scenario analyses that allow running through different revenue scenarios, as estimating revenues usually causes the most uncertainty.

Convincing analysis – or rather stress testing – can provide necessary certainty that your loan has a low credit risk to banks and investors receiving a fixed rate. They are then ready to discuss further loans, and offer better conditions. Savings received from these conditions over short periods of time are sizably bigger than costs for the analysis – which we offer at reasonable prices.

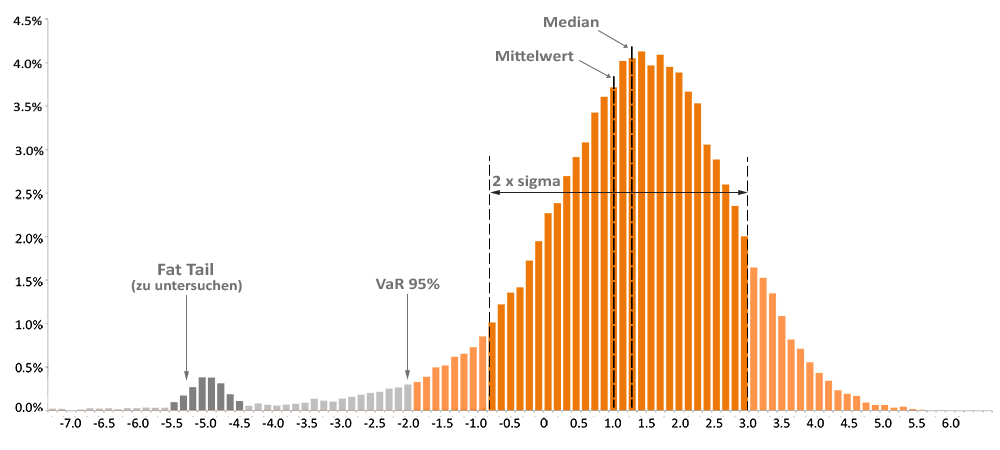

The following chart presents the distribution of real profits and losses. Such a distribution can be created by means of a simulation. Often with selective changes of input factors, it is possible to define how the changes influence the target variable, that is, when a company has a pre-existing integrated financial model.

Judging from our experiences in risk management and optimization of business processes, we tend to determine this concept not as loss limitation, but as an effective method to reduce costs and increase profitability. Well thought-out planning contributes significantly to effective risk management.

Other interesting articles:

- Withholding tax and dividends abroad

- Financial Planning: Typical Mistakes of Start-Ups

- How do I create business plan that will convince investors?

- Optimizing Strategy Through Financial Planning

- Financial Planning For Analysing Capital Requirements

- Welche Stundensätze für Dienstleistungen sind gerechtfertigt?

- Kosten eines Mitarbeiters auf Vollkostenbasis

Leave Comment