Inbound dividends and their withholding taxation

Are you a shareholder who owns foreign stocks? Then you are probably someone who has to deal with foreign dividends – and the corresponding withholding tax in your tax returns.

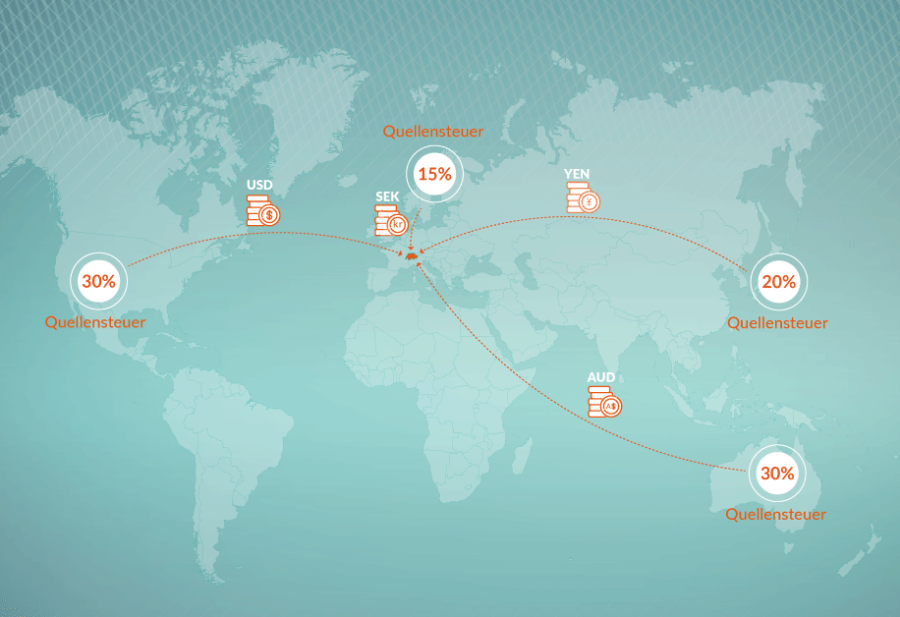

Dividends that accrue abroad are usually subject to withholding tax. In the end, the only thing deposited in the relevant bank account is the difference between the gross dividend and the foreign withholding tax (WHT).

At the same time, all dividends in Switzerland are subject to income tax, and must be declared. Swiss tax authorities require private investors to declare the gross dividend, i.e. declare the full amount, without taking into account / deducting the withholding tax already paid abroad. For certain trading accounts (e.g. at Saxobank Switzerland), the dividend report only shows the net value; in such cases, the gross income must be manually offset. This gross income is also used as the tax base in Switzerland – so, at first glance, it can look as though double taxation is taking place here.

Thanks to numerous double taxation agreements (DTA) between Switzerland and other countries, there is no double taxation in most cases – as long as the declaration in the tax return is correct. To avoid this type of double taxation, it is important to enter the dividends correctly in your private tax return.

A simple example – used below – shows how exactly the reduction/exclusion of double taxation works. In addition, we show a concrete example, drawn from practice.

Avoiding double taxation

What do I have to consider when completing a tax return?

Example:

Mr. Schweizer holds shares in a US company. In 2019, he received a gross dividend of CHF 100 (after conversion) from these shares, in the form of a dividend. The US withholding tax is 30%. As a result, an amount of CHF 70 was credited to his account (i.e. the gross dividend, minus the US withholding tax). In his private Swiss tax return, Mr. Schweizer has to declare the gross amount of CHF 100. At a tax rate of 20%, Mr. Schweizer has to pay an additional CHF 20 in taxes in Switzerland. The joint tax burden would thus be CHF 50 (American WHT + Swiss income tax), which, without further offsetting, would correspond to 50% of the dividends.

A double taxation agreement (DTA) has been in place between Switzerland and the USA since 1996. According to this double taxation agreement, part of the withholding tax already paid in the USA can be offset in Switzerland, against Swiss income tax. In concrete terms, this part is 15% (note: not 15% of the withholding tax, but 15% of the dividend!).

- Fill out form DA-1, and use it to apply for a flat-rate tax credit

- Enclose the relevant dividend receipt

Recommended:

Include a receipt showing the ISIN or the security number. This makes it easier for the cantonal tax office to process the information, and avoids overly laborious inquiries.

Recovery under the double taxation agreement

If the above example is run through (including the claim for refund), the result is as follows: in the USA, Mr. Schweizer pays a CHF 30 withholding tax. In his private tax return in Switzerland, he still declares a dividend of CHF 100 as income – but at the same time, applies for a flat-rate tax credit (Form DA-1), whereby CHF 15 (15% of CHF 100) is credited. This means that Mr. Schweizer pays just CHF 5 in taxes in Switzerland, instead of CHF 20. Instead of CHF 50, The total tax burden is now CHF 35. Thanks to the DBA, Mr. Schweizer has saved CHF 15 in taxes. The outcome: partial double taxation, or reduced double taxation.

| Situation without DTA | ||

|---|---|---|

| US dividends | CHF | 100 |

| US WHT | % | 30% |

| CH income tax | % | 20% |

| Situation with DTA | ||

|---|---|---|

| US dividends | CHF | 100 |

| US WHT | % | 30% |

| CH income tax | % | 20% |

| Due in CH | % | 15% |

| Reclaim in US | % | 15% |

| Taxation without DTA | ||

|---|---|---|

| US WHT | CHF | 30 |

| CH income tax | CHF | 20 |

| Total taxes (US + CH) | CHF | 50 |

| Taxation with DTA | ||

|---|---|---|

| US WHT | CHF | 30 |

| CH income tax | CHF | 20 |

| Due in CH | CHF | 15 |

| Income tax after CH credit | CHF | 5 |

| Total taxes (US + CH) | CHF | 35 |

| Total tax burden | % | 50% |

| Total tax burden | % | 35% |

Full recovery is rarely worthwhile

It is also possible to claim the remaining CHF 15 directly from the American authorities. In this case, the dividend of CHF 100 would be fully taxed in Switzerland. However, this route is significantly more complex, and experience shows that it is only worthwhile if the sums involved are very large. The reason: to request the return of this part. Mr. Schweizer must contact the American authorities directly, fill in the appropriate American forms, and so on. Alternatively, there is the possibility of contacting the bank abroad, and asking them for support. Such support is usually chargeable – whereby the costs for small investment sums are disproportionately high, and in extreme cases can even exceed the recoverable amount. And then there is the personal workload, which worsens the cost-benefit ratio once again. For these reasons, in practice, the remaining withholding tax amount is often waived.

Practical example

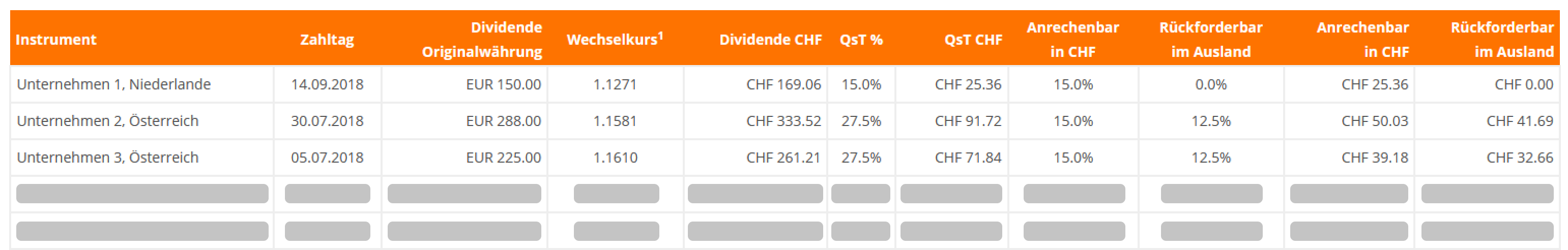

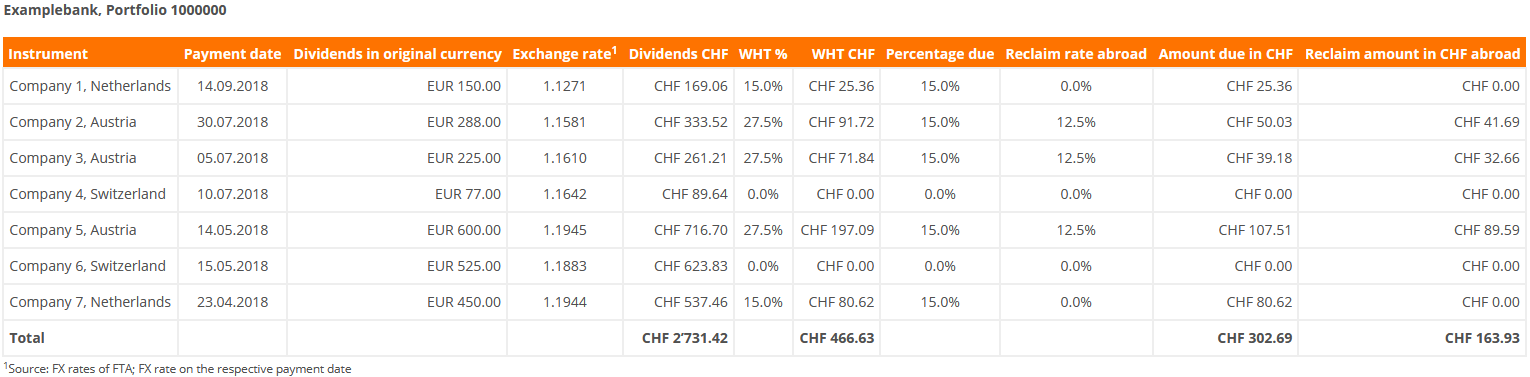

A diversified portfolio usually includes different positions in different countries, and in different currencies.

Examplebank, Portfolio 1000000

| Instrument | Payment date | Dividends in original currency | Exchange rate1 | Dividends CHF | WHT % | WHT CHF | Percentage due | Reclaim rate abroad | Amount due in CHF | Reclaim amount in CHF abroad |

|---|---|---|---|---|---|---|---|---|---|---|

| Company 1, Netherlands | 14.09.2018 | EUR 150.00 | 1.1271 | CHF 169.06 | 15.0% | CHF 25.36 | 15.0% | 0.0% | CHF 25.36 | CHF 0.00 |

| Company 2, Austria | 30.07.2018 | EUR 288.00 | 1.1581 | CHF 333.52 | 27.5% | CHF 91.72 | 15.0% | 12.5% | CHF 50.03 | CHF 41.69 |

| Company 3, Austria | 05.07.2018 | EUR 225.00 | 1.1610 | CHF 261.21 | 27.5% | CHF 71.84 | 15.0% | 12.5% | CHF 39.18 | CHF 32.66 |

| Company 4, Switzerland | 10.07.2018 | EUR 77.00 | 1.1642 | CHF 89.64 | 0.0% | CHF 0.00 | 0.0% | 0.0% | CHF 0.00 | CHF 0.00 |

| Company 5, Austria | 14.05.2018 | EUR 600.00 | 1.1945 | CHF 716.70 | 27.5% | CHF 197.09 | 15.0% | 12.5% | CHF 107.51 | CHF 89.59 |

| Company 6, Switzerland | 15.05.2018 | EUR 525.00 | 1.1883 | CHF 623.83 | 0.0% | CHF 0.00 | 0.0% | 0.0% | CHF 0.00 | CHF 0.00 |

| Company 7, Netherlands | 23.04.2018 | EUR 450.00 | 1.1944 | CHF 537.46 | 15.0% | CHF 80.62 | 15.0% | 0.0% | CHF 80.62 | CHF 0.00 |

| Total | CHF 2’731.42 | CHF 466.63 | CHF 302.69 | CHF 163.93 |

1Source: FX rates of FTA; FX rate on the respective payment date

As can be seen in the table (all information anonymised): a private investor received a total of CHF 2731.42 in dividends in a single tax year. The foreign withholding tax paid is CHF 466.63. Of this amount, CHF 302.69 is credited to domestic income tax in Switzerland. The remaining CHF 163.93 could be reclaimed separately in the respective country.

You can find out how large the creditable part and the recoverable part of the foreign withholding tax are for each country on the FTA website.

It should also be noted that not all countries levy a withholding tax. Great Britain is a good example of a country which does not.

| Country | WHT, in % | Reclaim rate in Switzerland, in % | Reclaim rate abroad, in % |

|---|---|---|---|

| Australia | 30 | 15 | 15 |

| Sweden | 30 | 15 | 15 |

| USA | 30 | 15 | 15 |

| Finland | 30 | 10 | 20 |

| Austria | 27.5 | 15 | 12.5 |

| Germany | 25 | 15 | 10 |

| Italy | 20 | 15 | 5 |

| Japan | 20 | 10 | 10 |

| Spain | 19 | 15 | 4 |

| Netherlands | 15 | 15 | 0 |

| Czech Republic | 15 | 15 | 0 |

| Luxembourg | 15 | 0 | 15 |

| France | 12.8 | 12.8 | 0 |

| Great Britain | 0 | 15 | 0 |

*all figures for investments under 10%.

Source: www.estv.admin.ch, State: 14.5.2020

Leave Comment