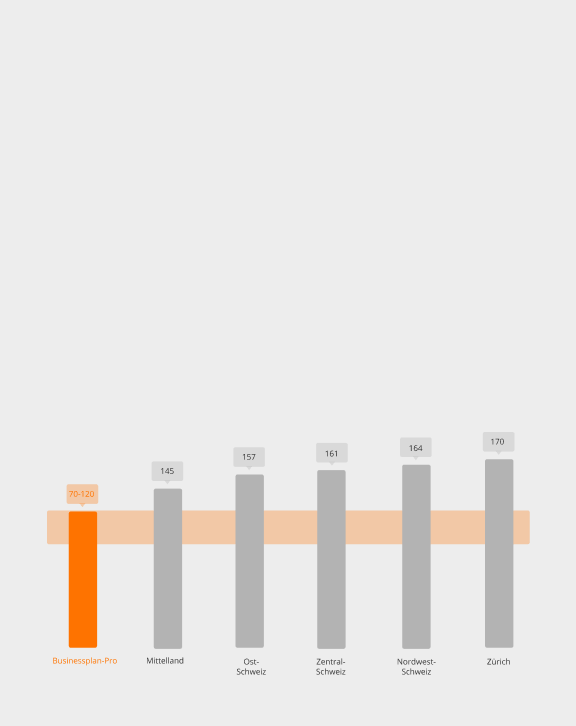

A car is considered an asset in Switzerland and consequently must be declared as a movable asset in the tax return. Although a car is taxed at much lower rates compared to income tax, its correct reporting can become a Herculean task for the average person. One of the main reasons for this is the diversity of methods for computing the remaining value, which serves as a basis for taxation and heavily depends on the internal rules of each canton. For example, a car might be taxed at a value of CHF 0 in Basel-Stadt, whereas the same car could be valued up to CHF 50,000 in Schwyz.

As tax advisors, we often have to answer the following question: At what value should the car be declared? Our clients are sometimes overwhelmed by the complexity and diversity of approaches regarding this issue, largely because various factors must be taken into account:

Assessment factors for the tax value of a private car

Purchase price

Year of acquisition

Vehicle type

Depreciation method

Depreciation percentage for each following year

The complexity becomes even more challenging when considering the rules defined at the cantonal level. To simplify this “mystery” for non-experts in this field, we offer a detailed overview of the rules to explain the ever-changing value of a car.

Overview table

| Canton | Tax value one year after purchase | Depreciation Method | Depreciation Rate | Special Cantonal Regulations |

|---|---|---|---|---|

| Aargau | 70% | Declining balance method | 30% 4 | Private vehicles are depreciated irregularly:

|

| Appenzell Ausserrhoden | 80% | Straight-line method | 20% | Generally, a residual value of 10% of the purchase price must be taken into account. |

| Appenzell Innerrhoden | 80% | Straight-line method | 20% | Generally, a residual value of 10% of the purchase price must be taken into account. |

| Basel-Country | 70% | Declining balance method | 30% 5 | From the 3rd year onwards, the value depends on the condition of the vehicle. This requires additional explanations in the tax return regarding the declared value. |

| Basel-City | - 1 | - 1 | - 1 | Private vehicles as personal use items are tax-free in the canton of Basel-Stadt (including motor vehicles for daily use). |

| Bern | 65% | Declining balance method | 35% | The depreciation rate of 35% does not apply to collector's vehicles: For them, the market value as of December 31st is decisive. |

| Fribourg | 30% | Declining balance method | 20% | Private vehicles are depreciated irregularly:

|

| Glarus | 70% | Declining balance method | 30% | The depreciation rate is 30% on the remaining balance. However, this does not apply to collector's vehicles: For them, the market value as of December 31st is decisive. |

| Grisons | 60% | Straight-line method | 10% | Private vehicles are depreciated irregularly:

|

| Lucerne | 70% | Declining balance method | 30% | - |

| Nidwalden | 60% | Declining balance method | 40% | - |

| Obwalden | 60% | Declining balance method | 40% | - |

| Schaffhausen | 60% | Straight-line method | 20% | Typically, the vehicle is declared at a value of CHF 1 in the tax return starting from the 5th year. |

| Schwyz | - 2 | - 2 | - 2 | Private vehicles in Schwyz are declared in the tax return at the market value of the car. |

| Solothurn | 50% | Declining balance method | 50% | - |

| St. Gallen | 80% | Straight-line method | 20% | Generally, the vehicle is declared in the tax return at a value of CHF 1 from the 5th year onwards. |

| Thurgau | 80% | Straight-line method | 20% | Typically, the vehicle is declared at a value of CHF 1 in the tax return starting from the 5th year. |

| Uri | 60% | Straight-line method | 20% | Private vehicles are depreciated irregularly:

|

| Valais | - 3 | - 3 | - 3 | Private vehicles are declared in the tax return at 80% of the insurance value at the end of the tax period. |

| Zug | 60% | Straight-line method | 10% | Private vehicles are depreciated irregularly:

|

| Zurich | 60% | Declining balance method | 40% | - |

1 CHF 0: Private vehicles including motor vehicles for daily use as personal use items are tax-free.

2 Private vehicles are declared at their market value in the tax return.

3 Private vehicles are declared at 80% of their insurance value at the end of the tax period.

4 Changeable depreciation percentage: Depreciation accelerates from the 5th year onwards.

5 The value depends on the condition of the vehicle, starting from the 3rd year onwards.

Tax value of the most popular car models

For a better overview, we have provided five detailed case studies. The Tesla Model Y, Skoda Octavia, BMW X1, VW Tiguan, and Mercedes-Benz GLC-Class are among the most popular vehicles in Switzerland based on data from 2024. Assuming all five cars were purchased in 2024, we have calculated their tax value in various cantons one year after purchase.

Purchase price – 55’680 CHF (2024)

Purchase price – 45’830 CHF (2024)

Purchase price – 72’500 CHF (2024)

Purchase price – 53’110 CHF (2024)

Purchase price – 99’320 CHF (2024)

Leave Comment