The beginning of every year is associated with delight, hopes for the future, and also with preparing the tax return where real estate must be reflected. This question is especially relevant to Switzerland, where not only domestically owned real estate but also those abroad must be taken into account when submitting tax returns. There are some common top questions that confront our clients most often:

- Why do I need to provide information about foreign assets if I have already paid taxes there?

- What does the term “Eigenmietwert” mean?

- How should these figures be calculated correctly and optimally from a tax perspective?

Our expert team has provided answers to these questions for you. Additionally, we have compiled an overview of all cantonal regulations: the percentages and calculation methods vary significantly from canton to canton. At the end, you will find a comparison of what a property would “cost” you in taxes in different cantons.

Declaration Obligation in Switzerland

According to Swiss tax law, both worldwide income and worldwide assets must be declared. However, only domestic income and assets are taxed. Foreign factors are only used to determine the tax rate. This principle does not violate bilateral double taxation agreements.

How is the tax rate of Declaration Obligation determined?

If you have a total wealth of CHF 100,000 in Switzerland and own a foreign property worth CHF 20,000, your Swiss wealth (CHF 100,000) will be taxed at the tax rate applicable to CHF 120,000 (CHF 100,000 + CHF 20,000). The same rules apply to income taxation.

Important

Switzerland has a progressive income tax. Therefore, the tax rate for CHF 120,000 is slightly higher than for CHF 100,000.

Eigenmietwert

Eigenmietwert is an important factor considered in the calculation of taxes for property owners. It is a unique aspect of the Swiss tax system. The term refers to the virtual income from a self-occupied property. This income is not realized and comes from the theoretically achievable rental value of the property. The stated rental price is considered as income in a natural form. This means that while the owner does not receive monetary income in the form of rent, they still earn income from the use of the property.

In the table below, you will find the most important information available to you for calculating Eigenmietwert. If the property was rented out during the year, the total rental income must be declared in the Swiss tax return instead of Eigenmietwert.

How is the tax rate of Imputed Rental Value determined?

If you have a total income of CHF 80,000 in Switzerland and you earn a virtual income of CHF 20,000 from the foreign property, your Swiss income (CHF 80,000) will be taxed at the tax rate applicable to CHF 100,000 (CHF 80,000 + CHF 20,000).

Important

In both examples provided, all figures are presented net (after deductions) for ease of understanding.

Correct Legal Tax Optimization

Eigenmietwert depends on the tax value of the property in most cantons. Therefore, all legal options should be used to reduce the tax value or Eigenmietwert. For example, in the canton of Aargau, there is a legal option to declare 80% of the market value of the foreign property. Eigenmietwert will be 3% of the declared value. Maintenance cost deductions are used to reduce Eigenmietwert. You can find more about this in the following blog.

Example:

Family A. lives in the canton of Schwyz and has Swiss assets worth CHF 200,000. Their annual income in Switzerland is CHF 100,000. They also own a property in the UK with a market value of GBP 128,430. Let’s calculate the imputed rental value of the property and determine the tax rate for income and wealth taxation.

- The tax value of the foreign property:

GBP 128,430 x 1.1172 (average annual exchange rate 2023 according to ESTV) = CHF 143,482 - Eigenmietwert of the foreign property:

CHF 143,482 x 3% = CHF 4,304

Since the property in the UK is 25 years old, a 20% flat-rate deduction can be claimed:

CHF 4,304 — 20% X CHF 4,304 = CHF 3,443 - Taxable income of the family:

CHF 100,000 - Applicable income tax rate:

The income of CHF 100,000 is taxed at the tax rate applicable to:

CHF 100,000 + CHF 3,443 = CHF 103,443 - Taxable assets in Switzerland:

CHF 200,000 - Applicable tax rate for taxation of assets:

The assets of CHF 200,000 are taxed at the tax rate applicable to:

CHF 200,000 + CHF 143,482 = CHF 343,482

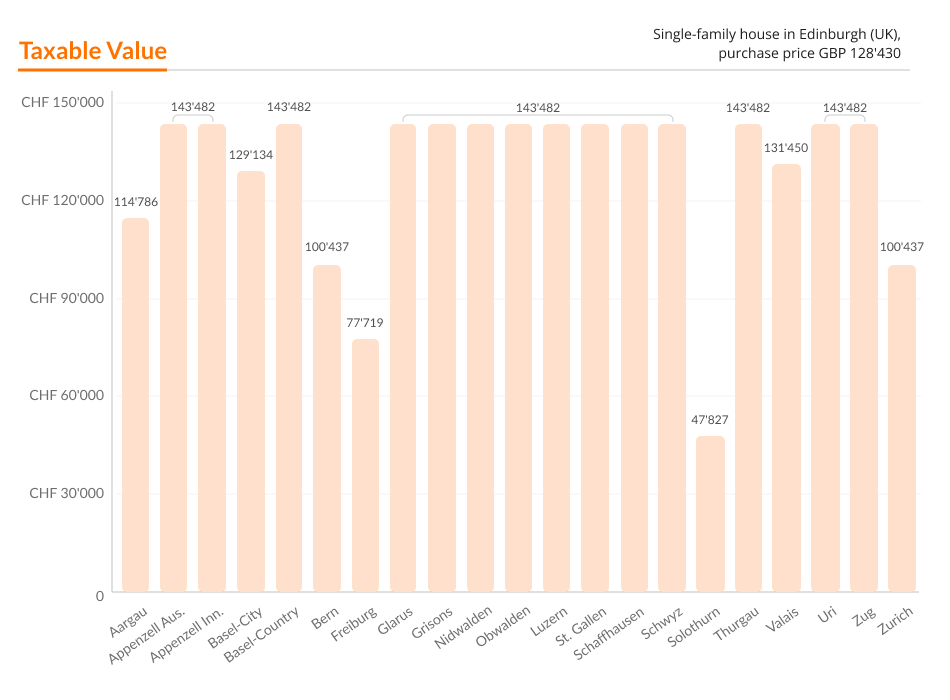

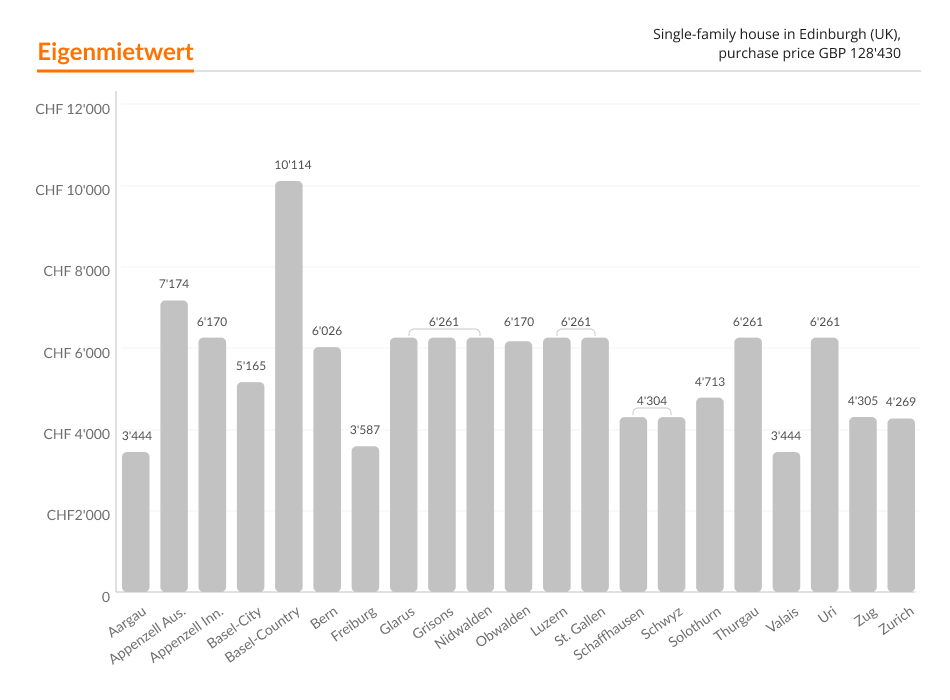

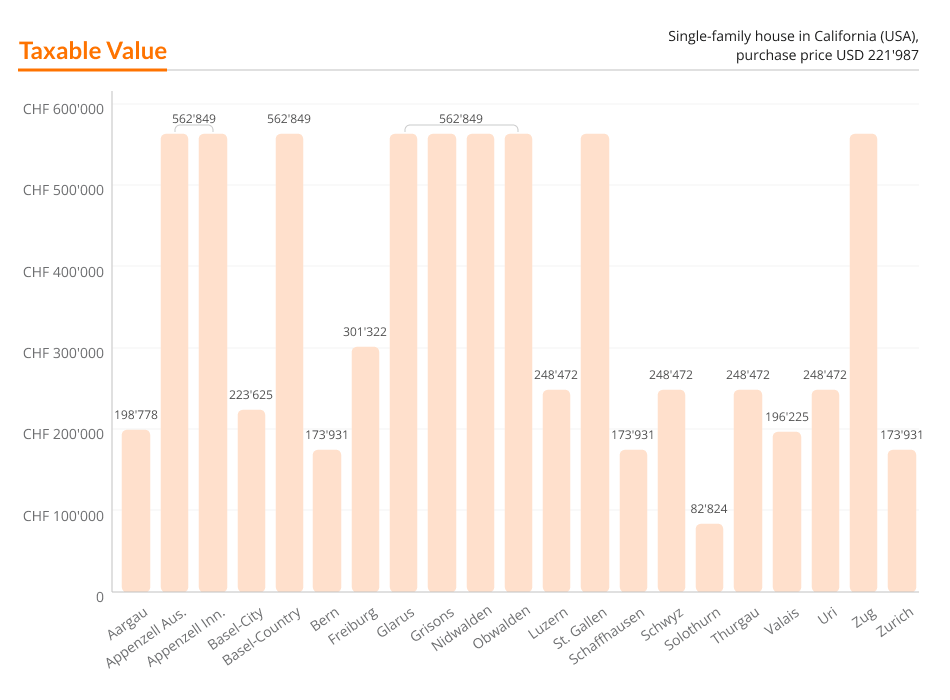

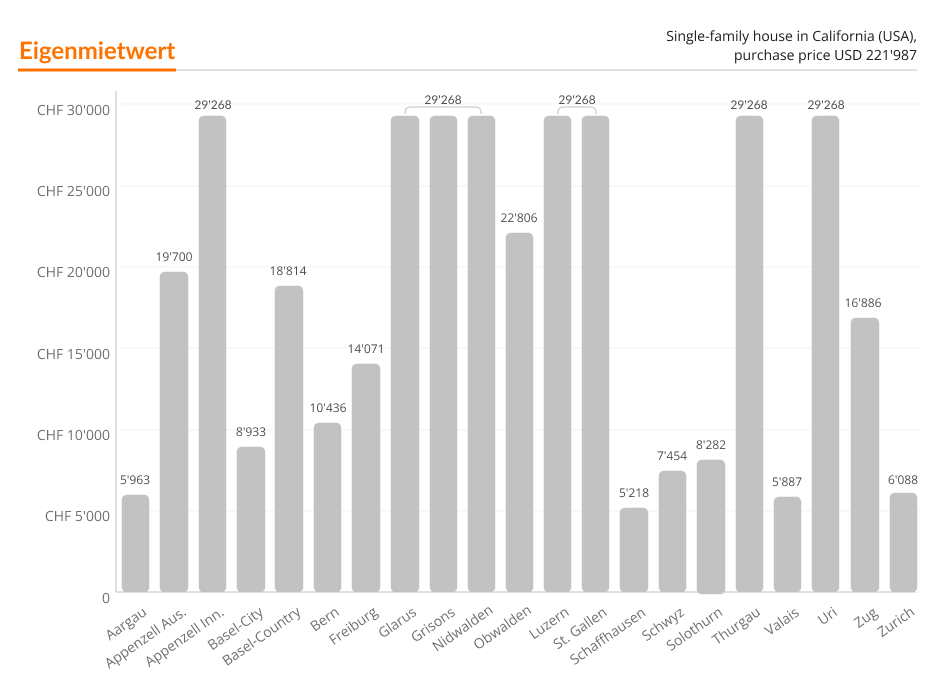

For better clarity, we have provided a more detailed presentation of two case studies. Assuming the properties are located in the UK and the USA, we have calculated the taxable value and the imputed rental value in different cantons.

Case 1 - apartment in Edinburgh (the UK), purchase price GBP 128,430.

Case 2 - single-family house in California (USA), purchase price USD 221,987.

Imputed Rental Value of the foreign property by Swiss canton

Canton Aargau

Tax value

The taxable value of foreign properties is set at 80% of the current market value.

Eigenmietwert

3% of the taxable value.

Canton Appenzell Ausserrhoden

Tax value

Foreign properties must be reported at the presumed market value.

Eigenmietwert

Market value serves as the basis for the computation:

- For market value up to CHF 250'000: 4.5-5% (max CHF 11'875)

- For market value from CHF 250'001 to CHF 500'000: 4-4.5% (max CHF 21'250)

- For market value from CHF 500'001 to CHF 750'000: 3.5-4% (max CHF 28'125)

- For market value over CHF 750'001: 3.5% (min CHF 28'125)

Canton Appenzell Innerrhoden

Tax value

Foreign properties must be reported at the presumed market value.

Eigenmietwert

Eigenmietwert amounts to 70% of the rental value and is usually adjusted to market developments every ten years with a revision of the tax values. This also occurs in the event of major renovations or extensions, or at the request of the tax authorities.

Canton Basel-City

Tax value

Privately owned properties and real estate located in the canton of Basel-City that are used by the owner are valued at their market value. Usually, tax value is determined by the tax administration according to the assessment notice.

Eigenmietwert

Eigenmietwert is based on the asset tax value. The applicable Eigenmietwert rate is recalculated for each tax period. It consists of the reference interest rate for mortgages at the beginning of the tax period and a surcharge of 1.75%. It amounts to a maximum of 4.5%.

For cantonal income tax, Eigenmietwert is set at 3.5% of the tax value, and for federal direct tax, it is set at 4% of the tax value.

Single-family houses and condominiums are taxed the same. Eigenmietwert amounts to a maximum of CHF 72'100 for the canton.

Canton Basel-Country

Tax value

Regardless of the type of use, properties, land, and real estate assets in private ownership are to be assessed at cadastral value. The cadastral value comprises the value of the land as well as the value of the buildings. The latter is based on the fire insurance value determined by the Basel-Country Building Insurance (based on 1939 values, which represent 100% and multiplied according to building type as per §18 Vo StG).

The market value of land and real estate is considered to be the average price achievable under normal circumstances in the district during the first 15 of the last 17 years prior to reassessment.

Eigenmietwert

Eigenmietwert of owner-occupied single-family homes and condominiums, including properties leased for enjoyment (such as life estates) and rights of use (including garages, parking spaces, garden swimming pools, garden pavilions, etc.), is derived from the simple taxable value of a property, which is further adjusted for tax purposes as follows:

- Regional adjustments based on municipal levels

- Adjustments based on the age of the property

From this taxable value, Eigenmietwert is calculated. For condominiums, this value is reduced to 90%.

Canton Bern

Tax value

For properties located abroad, 70% of the purchase price is to be reported as the taxable value.

Eigenmietwert

The rental value is 6% of the taxable value. If a foreign property is rented, the total rental income (excluding ancillary costs) is to be reported.

Canton Freiburg

Tax value

The cantonal tax administration calculates the taxable value using an individual assessment procedure based on room units and applies a special points system.

-

Taxable value = (2 x Earnings value + Market Value) / 3 -

Earnings value = Eigenmietwert / Percentage rate - Percentage rate:

- 8.50% for properties built before 1929;

- 8.25% for properties built from 1930 to 1960;

- 8% for properties built from 1961 to the present;

- 8% for condominiums and co-owned apartments.

Eigenmietwert

Eigenmietwert is calculated using a municipality-dependent coefficient and is generally around five percent of the taxable value.

Canton Glarus

Tax value

Foreign properties must be declared at the market value valid in the respective location.

Eigenmietwert

For owner-occupied properties, excluding vacation homes or second homes, a moderate rental value is applied, which according to cantonal regulations means 60% of the market rent.

For federal direct taxation purposes, Eigenmietwert that is applicable for cantonal taxes is automatically adjusted to the level demanded by the Federal Tax Administration, currently set at 70% of the market rent.

Canton Grisons

Tax value

The taxable value is calculated as follows: (2 x income value + 1 x market value) / 3

The amounts for income value, market value, and Eigenmietwert are part of the official appraisal of the apartment.

Eigenmietwert

Foreign properties must be reported with the presumed rental value. The rental value reduction in the canton is 30%.

Canton Lucerne

Tax value

The taxable value of residential properties or parts thereof that are permanently self-occupied at the place of residence is 75% of the cadastral value. Properties that are not permanently self-occupied (e.g., holiday homes) are, however, fully taxable at 100%.

Eigenmietwert

The rental value is considered the median market rent. This corresponds to the average rent that would be achievable for comparable rental properties in a similar location. Only 70% of the current rental value is taxable.

Canton Nidwalden

Tax value

The taxable values of out-of-canton properties must be obtained from the relevant tax authorities. If this value is unknown, the property must be reported at market value.

Eigenmietwert

Eigenmietwert is to be calculated based on the rental values on the reverse side of the notice concerning the valuation of immovable property. To achieve current values (market values), the government council sets a conversion rate annually. For the 2024 tax period, this rate is 100%.

Canton Obwalden

Tax value

Foreign properties must be declared at 100% of the market value.

Eigenmietwert

The rental value of self-used non-agricultural properties or self-used shares is generally 3.8% of the net taxable value (ordinary assessment).

Canton Schaffhausen

Tax value

Foreign properties must be reported at market value (purchase price).

Eigenmietwert

Eigenmietwert is to be determined by the Office for Property Valuation. This value was set during the last appraisal of the property and communicated to the property owner in the notice of the taxable value.

Canton Schwyz

Tax value

Foreign properties must be reported at the purchase price.

Eigenmietwert

Eigenmietwert for foreign properties is 3% of the taxable value.

Canton Solothurn

Tax value

The taxable value is set at 1/3 of the purchase price.

Eigenmietwert

The rental value of apartments in buildings of average construction is generally calculated on a flat-rate basis according to the percentages of the cadastral estimation allocated to the apartment for buildings and normal surroundings. It ranges from 8.8% to 10.63% of the calculated taxable value depending on the property group.

Canton St. Gallen

Tax value

Foreign properties must be reported at the presumed market value.

Eigenmietwert

Foreign properties must be reported with the presumed rental value.

Canton Thurgau

Tax value

If there is no estimated value according to a tax assessment, foreign properties must be reported at market value (purchase price).

Eigenmietwert

If there is no estimated value according to a tax assessment, foreign properties must be reported with the presumed rental value.

Canton Uri

Tax value

The estimated value according to the tax office's assessment must be declared. Properties used for agricultural or forestry purposes are to be taxed based on their income value.

If there is no estimated value according to a tax assessment, foreign properties must be reported at market value (purchase price).

Eigenmietwert

The applicable Eigenmietwert is determined according to the tax office's assessment. For multi-family houses, the comparable rent that could be achieved by renting to independent third parties is used for the owner-occupied apartment. The rental value of owner-occupied business premises must only be declared if the property is part of private assets.

Canton Valais

Tax value

For countries where a taxable value or cadastral value for the property exists, the following formula is used: Taxable value in Switzerland = Taxable value (cadastral value) abroad × 1.5 × 1.9

For countries where there is no taxable value or cadastral value for the property, the calculation basis is the purchase price of the property.

Eigenmietwert

3% of the taxable value.

Canton Zug

Tax value

Foreign properties must be declared at the market value valid in the respective location.

Eigenmietwert

Eigenmietwert is calculated as follows:

- 5% (or 5.5% for leasehold properties) of the taxable market value up to CHF 850'000 for single and two-family houses and up to CHF 750'000 for condominiums;

- plus 2% of the portion of the taxable market value exceeding CHF 850'000 (CHF 750'000);

- minus 40% reduction according to § 6 Abs. 1 of the Tax Ordinance of the Canton of Zug.

Canton Zurich

Tax value

For properties located abroad, 70% of the purchase price is to be reported as the taxable value.

Eigenmietwert

3.5% of the taxable value for a single-family house and 4.25% of the taxable value for a condominium.

If the foreign property is rented, the total rental income (excluding ancillary costs) is to be reported.

Leave Comment