Imagine you received a letter from the tax office about “Einkommensmanko” or “unerklärlicher Vermögenszuwachs” (income shortcoming), in which you are asked to explain the difference and explain the reasons. Likewise, sometimes you will need to explain a decrease in assets “Vermögensrückgang”. What exactly does it mean? Why does it happen and what could be the potential consequences. These are the questions covered in the following article.

How does the tax office ascertain the income shortcoming?

The tax office does not have direct access to the bank transactions, therefore it cannot assess directly if a person has falsely declared his/her income. But on the other hand, it can check the tax returns and compare them to each-other.

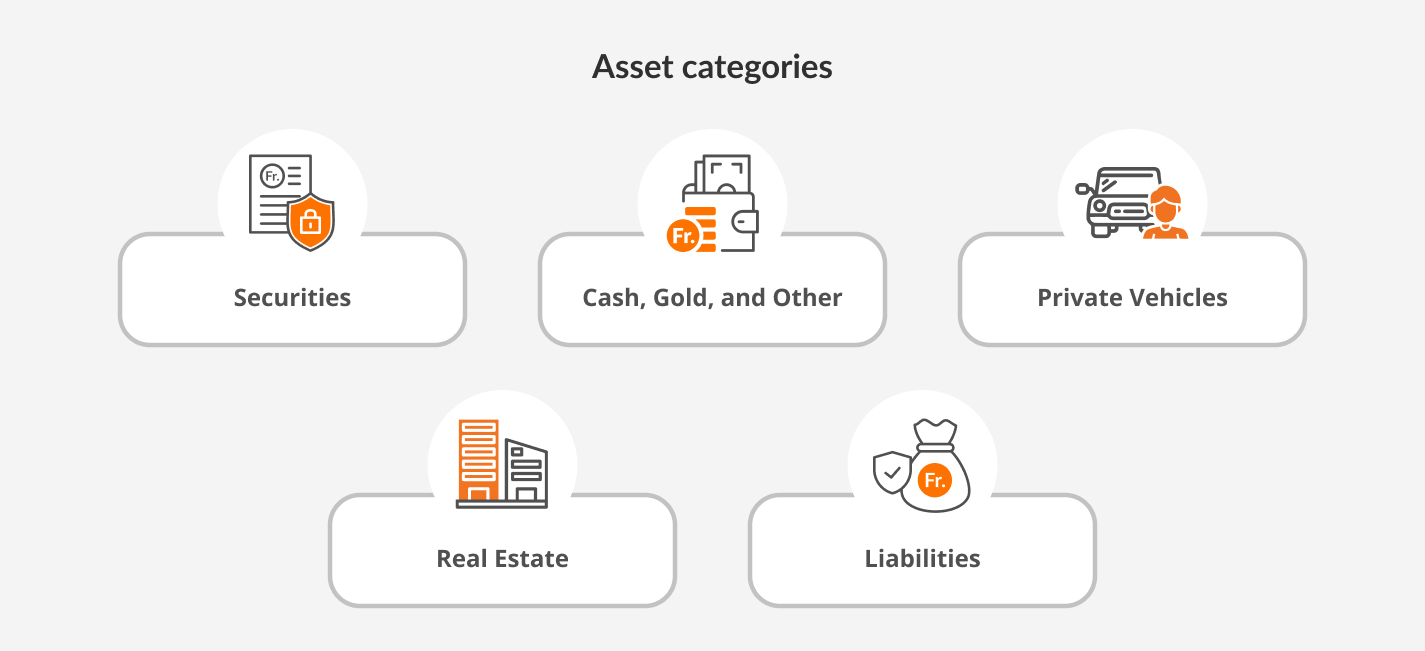

After comparing the net assets of the previous and current years, there will be an increase or decrease in the assets. Which can be explained by several factors:

- Tax-exempt income: capital gains, gifts or changes in property valuations can cause the fluctuations when comparing net assets.

- Eigenmietwert: although there is no actual cash inflow, the “Eigenmietwert” is still considered as income.

- Living costs: the minimum expenditure on living costs which is different among cantons.

Additionally, where other cash flows like real estate projects or major purchases are involved, these financial activities must also be taken into account. For instance, construction costs or financing inflows affect personal cash flow, which the tax office may also consider. In the case of commercial properties, capitalizations and depreciation are included, as asset calculations for such properties rely on their tax values.

Example

| Category | 31.12.2023 | Change Over Year | 31.12.2024 |

|---|---|---|---|

| Securities | CHF 350’000 | ↑ CHF 10’000 | CHF 360’000 |

| Cash, Gold, and Other | CHF 900 | ↑ CHF 600 | CHF 1’500 |

| Private Vehicles | CHF 12’000 | ↓ CHF 5’000 | CHF 7’000 |

| Real Estate | CHF 700’000 | ↑ CHF 20’000 | CHF 720’000 |

| Liabilities | CHF -200’000 | ↑ CHF 10’000 | CHF -190’000 |

| Net Assets | CHF 862’900 | ↑ CHF 35’600 | CHF 878’500 |

| Change in assets | CHF -15’600 |

Asset comparison

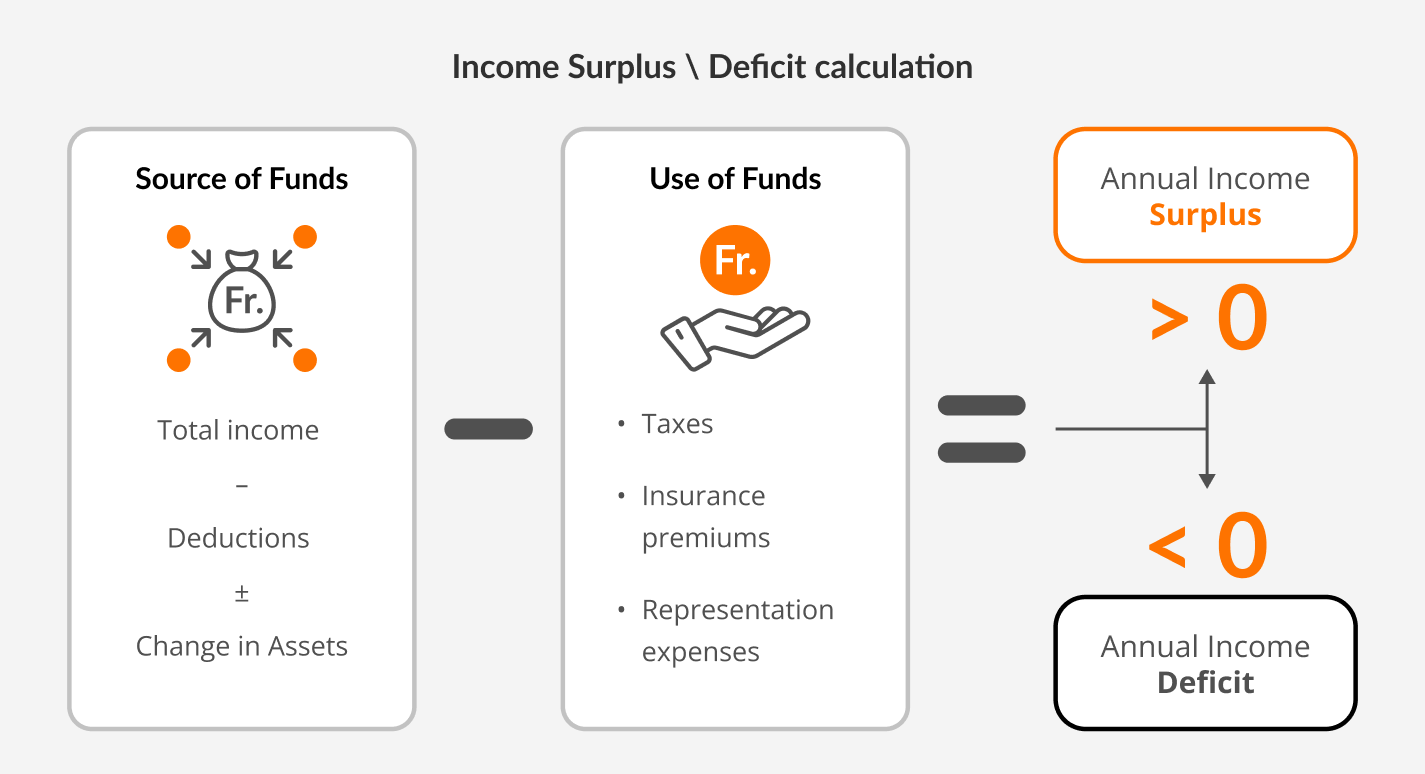

Once the assets are compared, any difference should be explained by the declared income. If the declared income cannot account for the increase in assets when comparing the net assets from the current and previous year, this results in an income deficit. Conversely, when the declared income exceeds the increase in assets, it is referred to as an income surplus.

While an income surplus is generally not considered suspicious by the tax office, an income deficit raises concerns, as it may indicate an increase in net assets that cannot be explained by the declared income. In such cases, the tax office will investigate the source of the discrepancy.

Important!

In the case of a significant income surplus, the tax office may still reach out to the individual, as the difference may often stem from assets owned by the person that were not included in the tax return.

Source of Funds 2024

| Description | Amount (CHF) |

|---|---|

| Total income (excluding real estate) | 145'000 |

| Deductions | |

| - Property maintenance costs | -8'900 |

| - Professional expenses | -2'100 |

| - Interest expenses | -4'500 |

| - Voluntary contributions | -500 |

| - Asset management costs | -750 |

| - Medical and accident costs | -2'200 |

| Net Taxable Income | 126'050 |

| Change in Assets (table 1) | -15'600 |

| Total Source of Funds | 110’450 |

Use of Funds 2024

| Description | Amount (CHF) |

|---|---|

| Expenditures | |

| - Paid cantonal and municipal taxes (including refunds) | 17'500 |

| - Paid direct federal taxes (including refunds) | 6'300 |

| - Costs for food, clothing, cosmetics, leisure, etc. | 25'000 |

| - Private insurance premiums | 5'500 |

| Total Use of Funds | 54'300 |

| Annual Income Surplus (Deficit if negative) | 56'150 |

Consequences of Income Deficit

The tax office will first attempt to address the income deficit by sending a letter to the individual, giving them the opportunity to clarify the matter. If no response is received, the tax office will proceed with an assessment, assuming that the income deficit is due to undeclared income (“black money”). This assumption may lead to proceedings for attempted tax evasion, and in extreme cases, for tax fraud.

What to do

When you receive the comparative asset calculations from the tax office, it is essential to take them seriously, review every detail, and contact the relevant authority as soon as possible. If an income deficit is identified in the calculations, it is important to be able to give a solid explanation, which will prevent any potential negative results. It should also be noted that, there is no need to panic, because tax office calculations are often incomplete, resulting in unjustified discrepancies.

In most cases, the reasons for a wealth deficit are straightforward and can be quickly identified. Some common examples include:

- Tax-free gifts or inheritances that were omitted from the declaration

- Tax-free capital gains from the sale of assets such as securities, vehicles, or property

- Accruals that are not accounted for in the correct year, such as invoices for house construction paid in January but related to December

- Capital gains from 2nd and 3rd pillar pension payments (not declared as income)

More complex situations arise when significant investments or portfolio restructuring occur, typically accompanied by relatively low income. In such cases, even minor discrepancies in assets—such as incorrect accruals or undeclared capital gains—can significantly impact income and lead to an income deficit (for instance, during a property construction project).

Conclusion

In conclusion, an income deficit is often not a major issue, as it is typically caused by miscalculations or the omission of certain assets in the declaration. However, it is crucial to respond promptly and responsibly to avoid further complications. Seeking assistance from a professional can be a wise step to ensure that the situation is handled properly and efficiently.

Weitere interessante Artikel zum Thema:

Leave Comment