For every employee working (partially) from home, the question arises at the latest with the arrival of the tax declaration: Are certain home office expenses deductible from taxable income, or better yet, should they be reimbursed by the employer?

That’s correct—this is a simple way to optimize taxes. Read on to learn how it works.

Since the COVID-19 pandemic, home office work has become widespread in Switzerland, although it has slightly declined as many team leaders and business owners prefer to see their employees regularly in the office again. Nevertheless, the topic remains highly relevant, and a complete return to 100% office work is not foreseeable for the majority of office jobs.

How do I calculate home office costs?

Relevant costs for employees include:

- Gross rent for an (additional) home office, including proportional heating costs. The relevant rental costs are calculated using the following formula:

Office Use of Room (%)

*

Gross Rent*

Office Space in m2Total Living Space in m2Alternatively, if the room is used exclusively as a home office:

Gross RentNumber of Rooms in Apt. + 1 - Proportional costs for electricity, internet, and fees for television or radio reception (Serafe)

- Costs for office equipment: Office chair, desk, PC/laptop, monitor(s), printer, telephone, lamps, filing cabinet, etc.

- Consumables: Stationery, printer paper, envelopes, stamps, etc.

Tax authorities in Switzerland do not define minimum or maximum rates for the setup or “operation” of a home office. As is customary in Switzerland, common sense should prevail, and excessive claims that might prompt inquiries from tax offices should be avoided.

Strictly speaking, the reimbursement or deduction of actual expenses in the tax declaration is only possible if no dedicated office room already exists in the home. However, in practice, it is nearly impossible for a tax office to verify when and how you set up your home.

Nevertheless, proof through receipts is required, meaning only actual expenses from the current tax year can be claimed. The largest cost component is likely to be the rent allocated to the room.

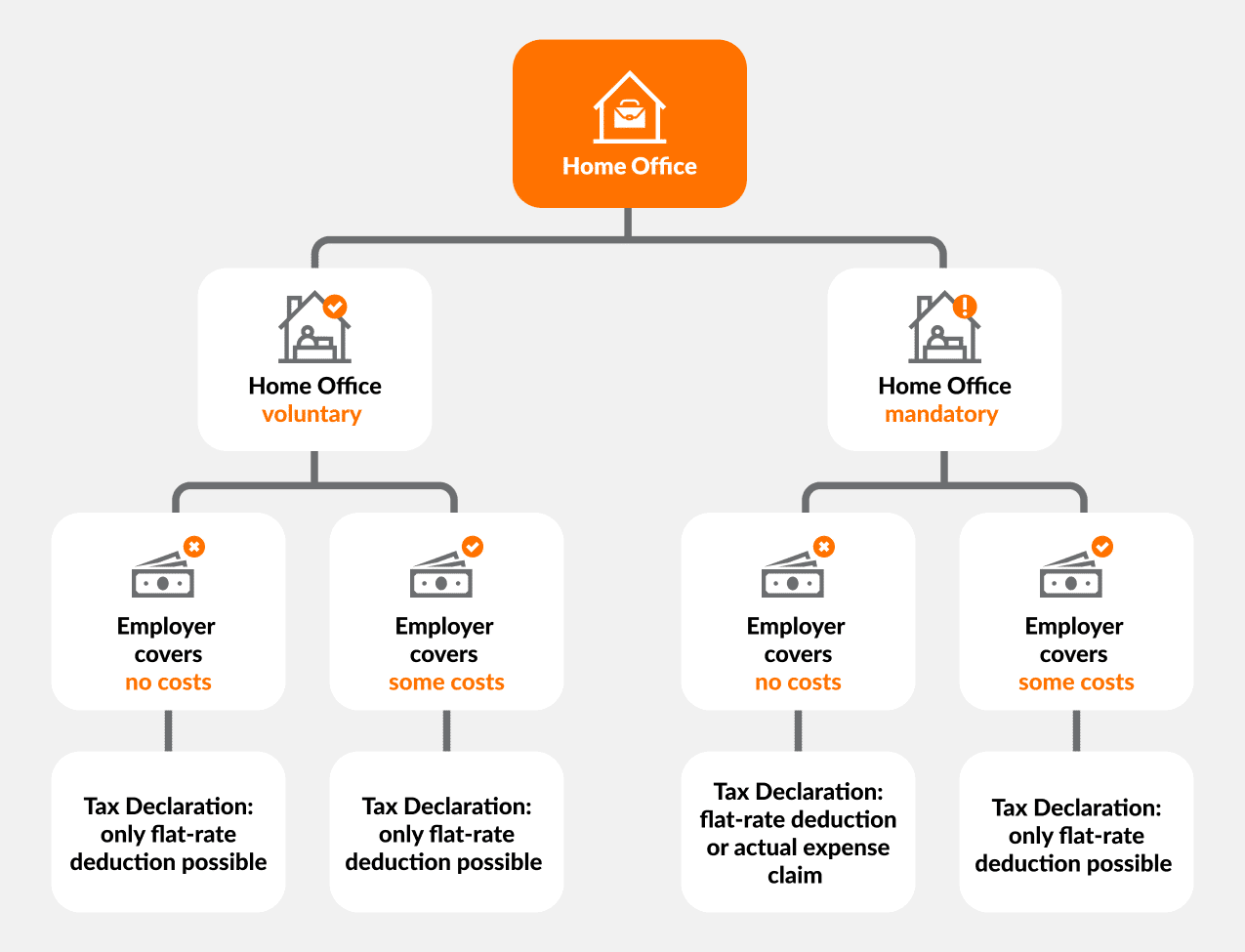

Overview of home office expense reimbursement and implications for the tax declaration

Examples of dividing home office costs between employer and employee

Situation 1

The employer provides you with an office workspace free of charge (either a permanent, personal desk or a so-called “hot desk”).

Option A: Employer does not cover home office expenses

You do not receive any cost contributions from your employer for home office expenses and must over all costs yourself. This practice is legal. But how can you claim your expenses as professional costs in your tax return?

In this case, the tax office assumes that you voluntarily work from home and that the expenses were incurred without necessity.

You can claim the standard deduction for professional expenses (in the Canton of Zurich, 3% of your net salary), but nothing more.

Option B: Employer provides home office expense compensation

Your employer compensates you for home office expenses, either as a flat rate or based on actual costs.

In this case, the tax office assumes that you voluntarily work from home and that the expenses were incurred without necessity. Consequently, the home office expense compensation is considered as salary and must be declared by the employer on the salary certificate. Social security contributions must be paid on this amount, and you are required to pay income tax on it privately.

Situation 2

The employer does not provide you with a workplace; the work must be carried out in a home office by default.

Since your home serves as your workplace in this scenario, you can even claim travel costs to your employer’s office as professional expenses. It is important to document these trips carefully and, ideally, have them signed off by your supervisor.

Option A: Employer does not cover home office expenses

This practice is very employee-unfriendly and not permissible, as the employer is obligated to provide employees with the necessary work materials (Art. 327 of the Swiss Code of Obligations).

In such cases, you should negotiate a more favorable solution with your employer. Additionally, it is advisable to collect all purchase receipts and documents to claim actual professional expenses in your tax return if your employer does not agree to cover the costs. However, a higher deduction is only possible if your actual expenses exceed the 3% of net salary standard deduction that employees in dependent employment can claim (e.g., in the Canton of Zurich).

Option B: Employer covers home office expenses either as a flat rate or based on actual costs

In this case, the employer’s compensation is considered an expense reimbursement, which is exempt from income tax and social security contributions. However, you can still claim the 3% of net salary standard deduction for professional expenses in your tax return.

If the employer provides compensation on a flat-rate basis, it should approximately align with the actual costs incurred by the employee.

Caution!

Excessive or unrealistic expense compensations may be regarded by the tax office as concealed salary payments, leading to back-payment claims from social security offices or tax authorities. For evidentiary purposes, we recommend keeping all purchase receipts in all scenarios.

Conclusion

For most employees, working from home is likely voluntary. In practice, expense reimbursements for home office costs are therefore rarely encountered. This is understandable, as employers often still have to pay for office rents. However, if working from home is mandatory, you should definitely negotiate a fair expense reimbursement arrangement. The deductions allowed by tax authorities on taxable income have a relatively small impact and do not adequately cover your expenses. If in doubt, it is advisable to consult a tax advisor.

More interesting articles on this topic:

Leave Comment