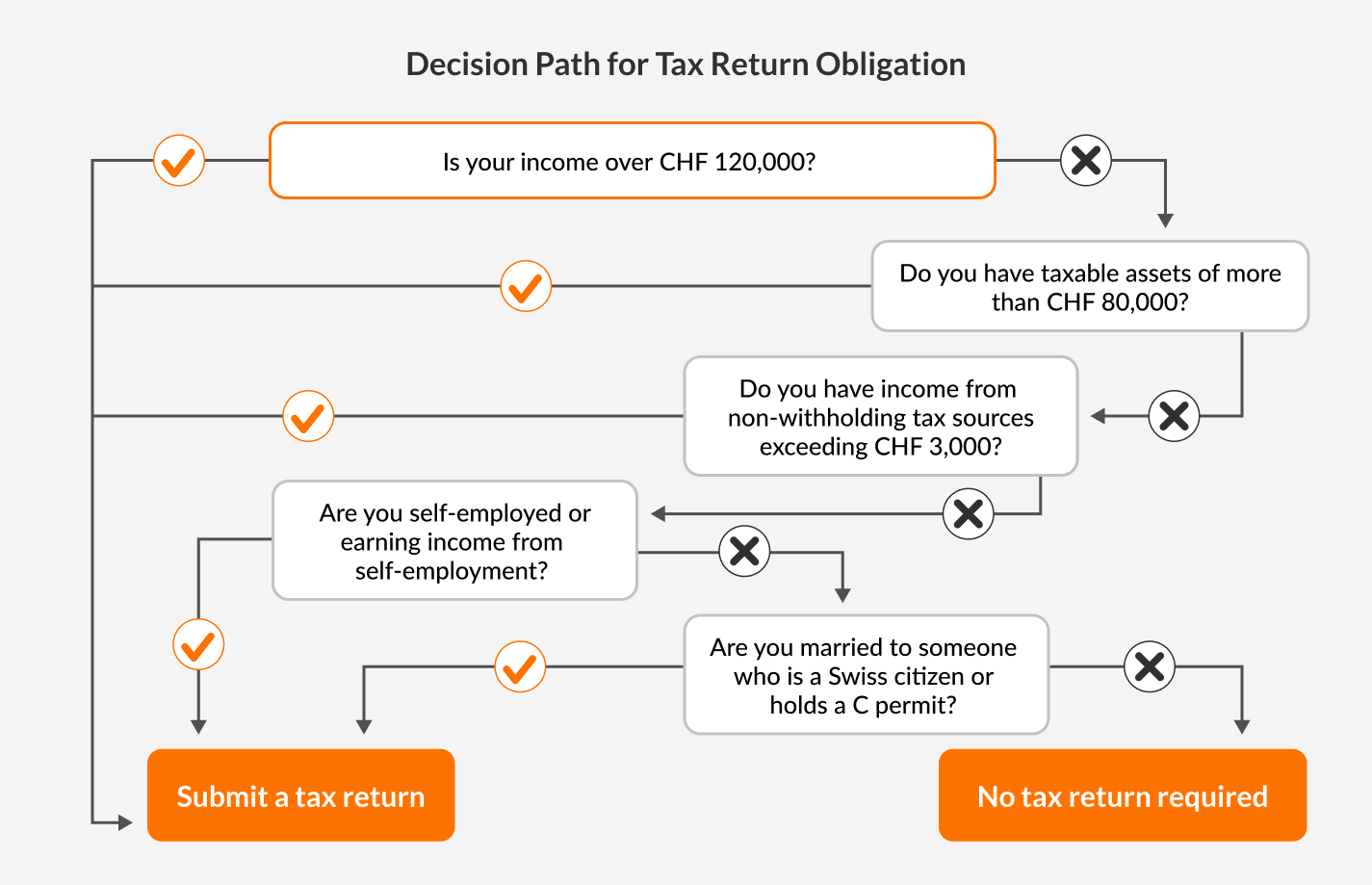

When exactly, and under what conditions, must an expat in Switzerland file a tax return? For most foreigners, taxes are deducted directly from their salary as withholding tax . But does this mean they don’t have to file a tax return? Many people are aware that expats must submit a tax return if their annual income reaches CHF 120,000. However, this criterion is just the beginning of the decision-making process, not the end.

That’s why our experienced tax team has created a guide on this topic—to bring some clarity to the matter. In this guide, you will learn in which cases you are required to file a tax return and why it might even be beneficial to do so voluntarily, even if you are not obligated to.

Obligation to Submit a Tax Return

Expats—i.e., individuals without Swiss citizenship or a C-permit—are legally subject to a withholding tax rate. In this case, the employer deducts and remits the withholding tax directly from the salary before it is paid out.

However, as is often the case, there is a “but”: If a certain income or asset threshold is exceeded, the standard Swiss tax procedure applies, and the individual is then required to complete and submit a tax return within the given deadline.

Criteria for tax return obligation

- Income

- Taxable assets

- Income from sources not subject to withholding tax

- Income from self-employment

- A spouse with Swiss citizenship

How can you determine whether you are required to submit a tax return based on these criteria? Switzerland has a clear algorithm that allows for a quick assessment of whether a tax return is necessary.

A closer look at the individual criteria:

A. Income of CHF 120,000 or more

As soon as a person’s or their spouse’s gross annual income reaches at least CHF 120,000, filing a tax return becomes mandatory.

Important!

Once a person becomes subject to the standard tax assessment, this process continues in the following years—even if their income temporarily or permanently falls below the CHF 120,000 threshold.

B. Self-Employment

Anyone who is self-employed has no choice: filing a tax return is mandatory.

C. Non-withholding tax income of CHF 3,000 or more

Even if the primary income comes from salary payments, there are other sources of income that are not taxed at the source, such as:

- Returns from securities (e.g., dividends, interest)

- Rental income from real estate

- Alimony payments (spousal or child support)

- AHV pensions

- Lottery or gambling winnings

Owning real estate abroad also falls under this category—even if taxes have already been paid in the foreign country. Once non-withholding tax income reaches CHF 3,000, filing a tax return becomes mandatory.

D. Taxable assets

Individuals with taxable assets of at least CHF 80,000 (single) or CHF 160,000 (married couple) must file a tax return.

E. Married to a Swiss citizen or C-permit holder

Love and finances are often closely linked. Regardless of income or assets, if a person’s spouse holds Swiss citizenship or a C-permit, they are subject to the standard tax rules applied to Swiss residents.

Important!

If you’re waiting for the tax office to remind you about your obligation to file a tax return—think again. In Switzerland, you are personally responsible for submitting your tax return on time, whether online or by mail.

Even if you don’t receive a notification from the tax office, it’s still your duty to take care of it yourself. And let’s be honest—no one wants to pay a hefty fine just for missing the deadline. A failure on the part of the authorities does not exempt you from your obligation to file and pay taxes correctly.

Income and assets outside of Switzerland

Income, including securities and other assets, must be declared in the tax return. But what about assets abroad or income earned outside Switzerland? These must also be reported in the Swiss tax return, even if they have already been taxed in another country.

No need to worry—this doesn’t mean you’ll have to pay taxes twice. Switzerland has double taxation agreements (DTAs) with most countries to prevent this issue. However, since Switzerland has a progressive tax system, the tax office needs a full picture of your total income and assets to determine your tax rate and apply the correct taxation to your Swiss-based income or wealth.

Filing a tax return voluntarily: Does it make sense?

At first glance, voluntarily filing a tax return may seem like an unnecessary hassle. But in reality, it can save you money by reducing your tax burden. The main reasons for this are potential deductions and the refund of withholding tax.

Reason 1: Reducing taxable income through deductions

If you are subject to withholding tax, it is calculated as a flat rate on your gross income and deducted directly from your salary—without considering your actual expenses. However, if you file a tax return, you can claim various deductions (e.g., work-related expenses, insurance premiums, or tuition fees). This lowers your taxable income and often results in a lower tax burden.

Reason 2: Reclaiming the Withholding Tax

If you receive interest income, dividends, or certain capital gains, you may already be familiar with the 35% withholding tax. This tax serves as a safeguard against tax evasion. The good news is: If you correctly declare your income and assets in the tax return, you can reclaim the deducted withholding tax—fully or partially.

Important!

What happens if the withholding tax you’ve already paid is higher than the actual tax owed according to your tax return? It’s simple: After submitting your tax return, you can request a tax refund from the tax office.

Example

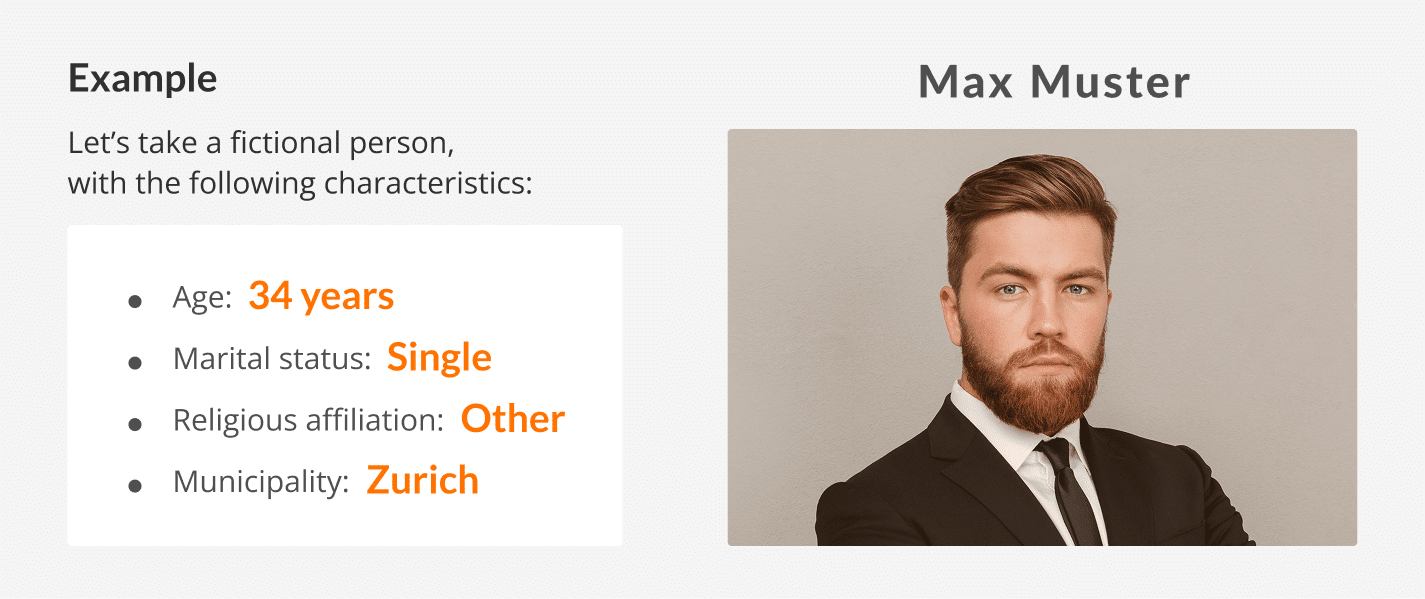

Let’s take a fictional person, Max Muster, with the following characteristics:

- Name: Max Muster

- Age: 34 years

- Marital status: Single

- Religious affiliation: Other

- Municipality: Zurich

| Description | No tax return, only withholding tax | Tax return with deductions |

|---|---|---|

| Gross salary total | CHF 278,500 | CHF 278,500 |

| Contributions OASI/IV/EO/ALV/NBUV | CHF 16,780 | CHF 16,780 |

| Regular contributions 2nd pillar | CHF 8,620 | CHF 8,620 |

| Withholding tax deduction | CHF 63,190 | - |

| Work-related expenses | - | CHF 9,670 |

| Contributions to 3rd pillar | - | CHF 7,056 |

| Insurance premiums | - | CHF 2,750 |

| Management of private movable assets | - | CHF 810 |

| Total deductions | - | CHF 20,286 |

| Net income (after deductions) | CHF 253,100 | CHF 232,814 |

| Taxes | CHF 63,190 | CHF 56,462 |

| Difference | CHF 63,190 – CHF 56,462 = CHF 6,728 | - |

Reason 3: Protection against unexplained asset discrepancies

Filing a tax return helps maintain a regular overview of all income and assets—both in Switzerland and abroad. This provides significant advantages: first, you always have a clear picture of your total wealth and won’t forget to declare it to the tax authorities. Additionally, it acts as a safeguard against potential income gaps that may arise if the tax office scrutinizes your assets and detects an unexplained, significant discrepancy between different tax years. Such discrepancies often result from simple errors and can lead to additional taxation—or, in severe cases, even penalties.

Filing a tax return: Checklist

How do I proceed with filing my tax return, and what documents do I need?

Phase 1.

Collecting the required documents

Before starting to fill out the tax forms, ensure you have all the necessary documents. These primarily include:

- Salary statements from your employer

- Unemployment insurance certificates for received benefits

- Pension benefit statements

- Interest and dividend statements

- Purchase and sales receipts for bonds, stocks, etc.

- Securities account statements from custodian banks

- Proof of contributions to pension funds (if not included in the salary statement)

- Certificates from insurance providers or contributions to the third pillar (Pillar 3a)

Phase 2.

Completing your tax return

Once you have gathered the necessary documents, visit the website of your local tax office and download the software required to fill out the form. At this stage, many expats face challenges, particularly when dealing with the software interface, specific terminology, or technical language. However, there is a way to make this phase less overwhelming.

Tip

It is not uncommon to delegate tax return preparation to firms with professional expertise in this field. This can help you avoid unnecessary stress, prevent errors, and—just as importantly—maximize deductions on your taxable income. If the service fee seems like an obstacle, it’s worth honestly comparing the actual cost (fees) with the potential costs of errors or a higher tax burden. More often than not, the outcome of this comparison does not favor the DIY approach.

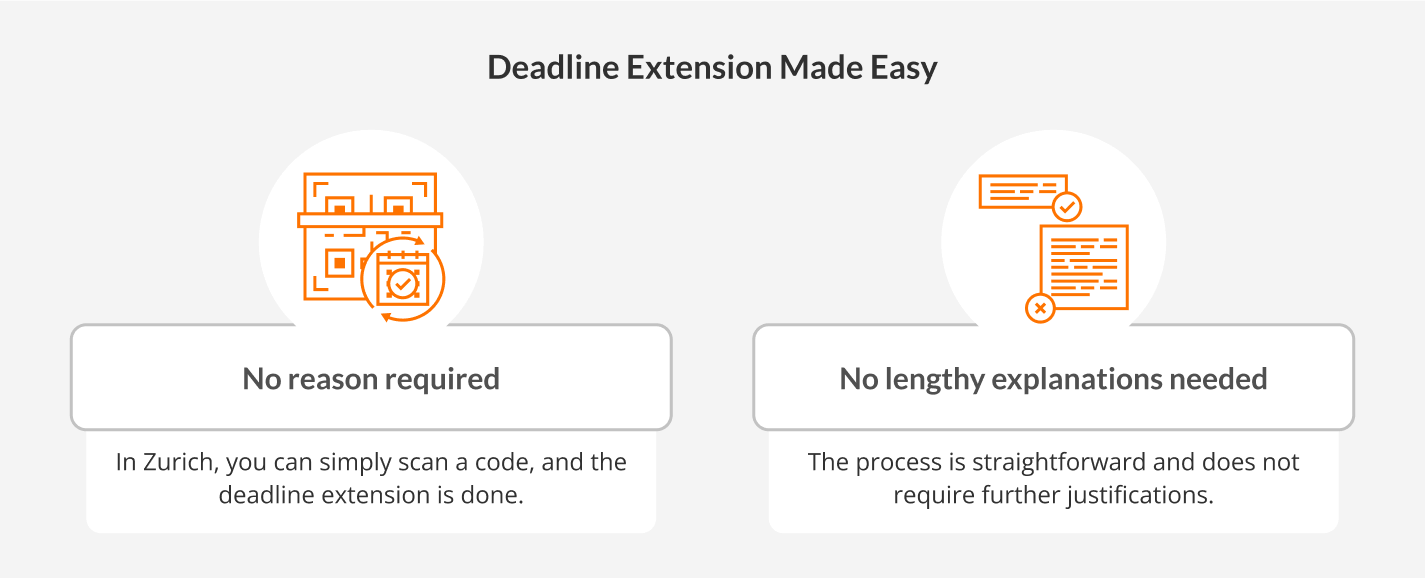

Don’t miss the Swiss tax return deadline

The general deadline for filing your tax return, as found in various sources, is usually March 31. As a precaution, it is generally recommended to extend this deadline:

Conclusion

As previously outlined, there are numerous intricacies in filing a tax return that everyone living in Switzerland should consider. This can be particularly challenging for expats who are not entirely familiar with Swiss laws and the official languages of the cantons. However, as we have observed, filing a tax return can transform from an obstacle into a valuable opportunity to save on taxes.

For this very reason, our experienced team – with years of expertise in this field – is here to assist you with the swift and competitively priced preparation of your tax return, even if you are not yet obligated to file one.

Leave Comment